Please be sure to enter your Member ID WITHOUT

the NSA prefix—only the numbers, no letters.

Please be sure to enter your Member ID WITHOUT

the NSA prefix—only the numbers, no letters.

Anthem is now the SAG-AFTRA Health Plan’s behavioral health provider network

Note on automatic premium payments (ACH): If you pay premiums by ACH, your January 1, 2026 premium may show as “paid” in Benefits Manager before funds are withdrawn from your bank account.

Anthem replaced Carelon Behavioral Health as the Plan’s behavioral health network for behavioral health services. In-network benefits for behavioral health will apply only to providers and hospitals in Anthem’s behavioral health network.

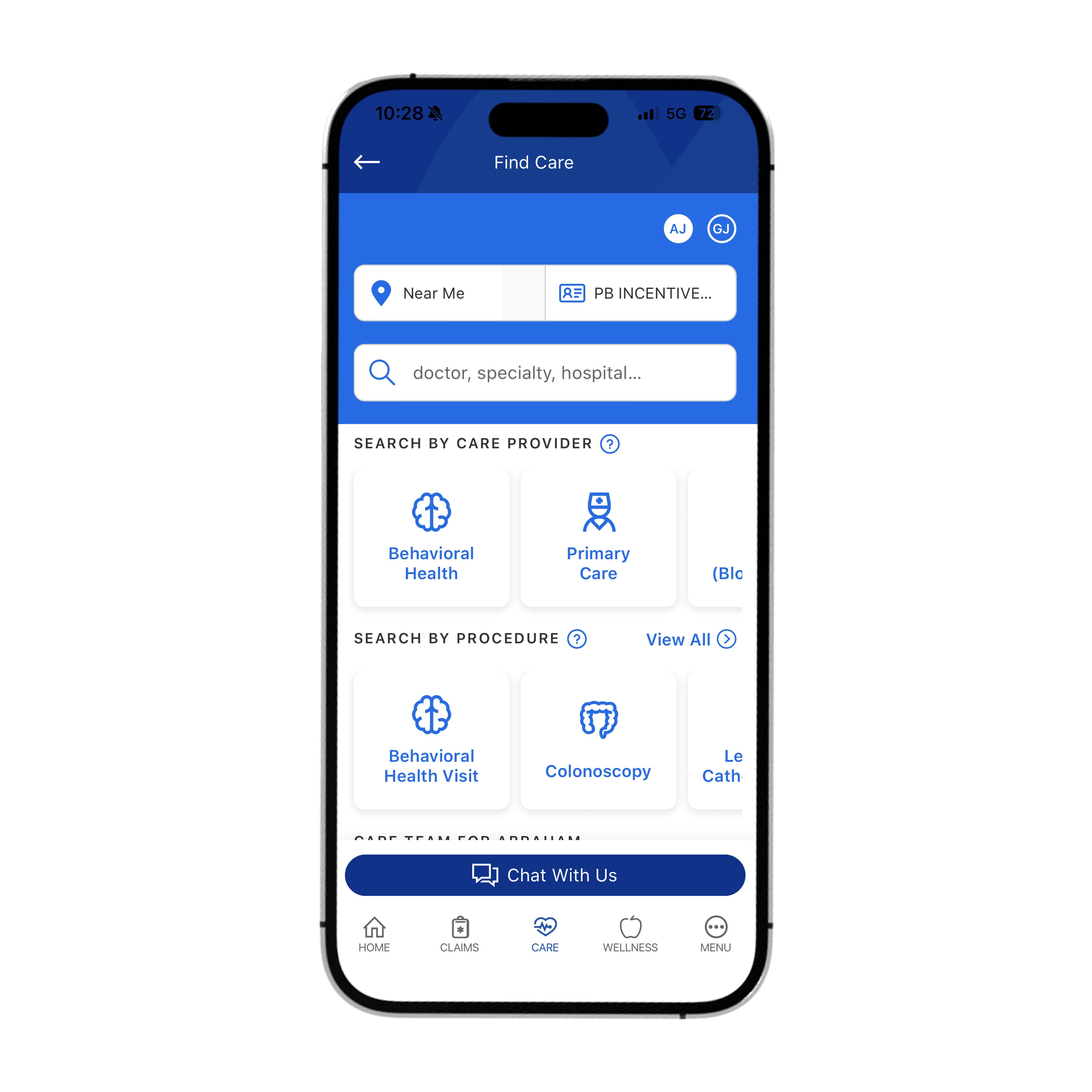

Use the Sydney Health app or Anthem Member Portal and search specifically for providers in the Anthem Behavioral Health network, or call Anthem Health Guides at (833) 414-5790.

Virtual therapy options such as LiveHealth Online, Talkspace, Ria Health, Headway, Alma, and others remain available. Licensed clinicians are available 24/7 for behavioral health support.

The out-of-network level of benefits will apply to covered behavioral health services from out-of-network providers. However, if no in-network provider is available or the claim falls under the No Surprises Act exceptions, in-network benefits may apply.

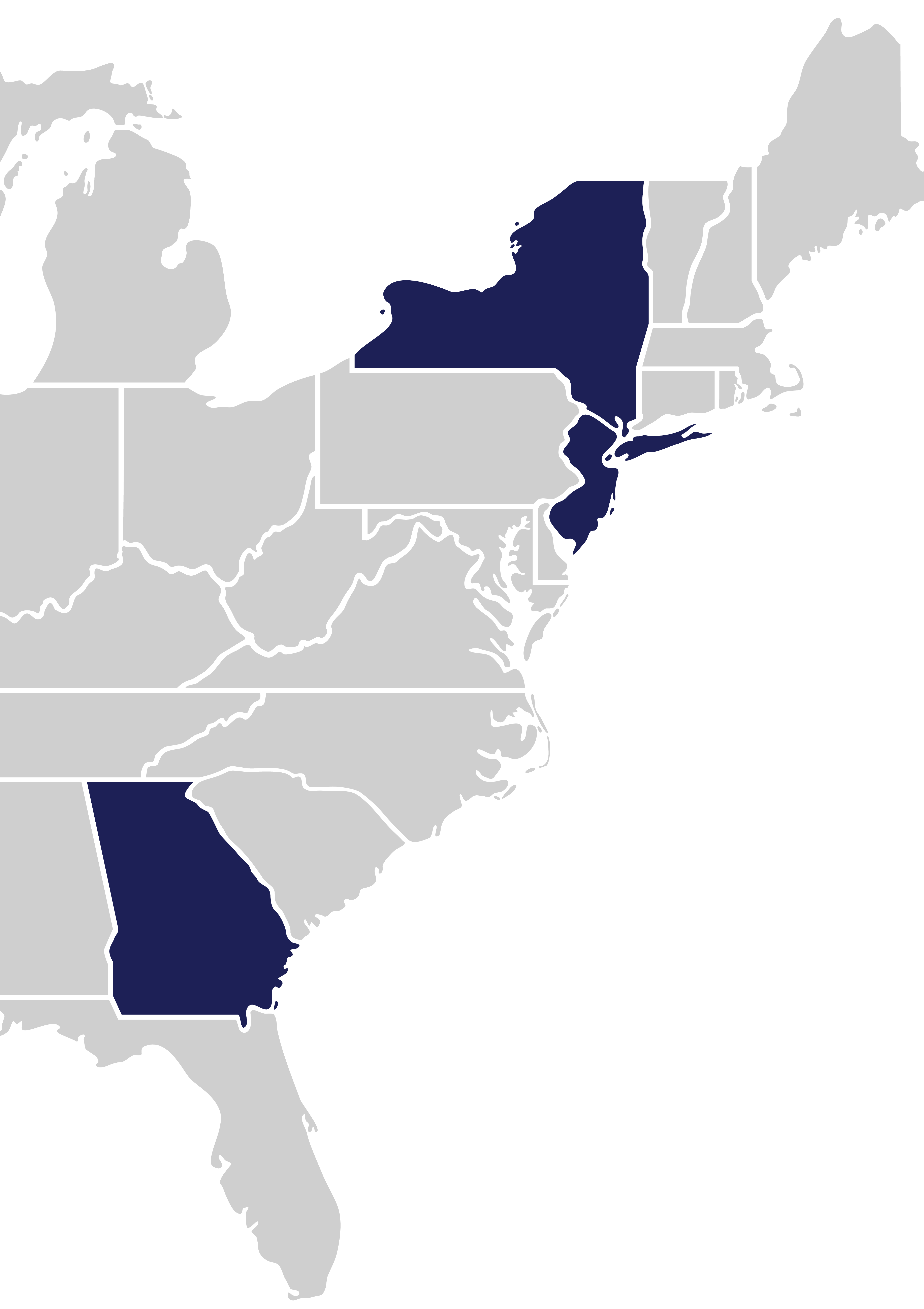

Residents of these states will access providers and hospitals through Anthem’s Select Network. For residents of these states, in-network benefits will apply only to Anthem Select providers and hospitals in their home state after January 1, 2026.

Even though almost all current providers remain in the Select Network, they have agreed to provide better provider discounts, which translate to lower out-of-pocket costs for you.

Call Anthem Health Guides at (833) 414-5790. Or, after January 1, 2026, use the Sydney Health app or Anthem Member Portal.

When you travel outside New York, New Jersey, or Georgia, you’ll continue to use Anthem’s BlueCard PPO network for in-network benefits. To find a provider, call Anthem Health Guides at (833) 414-5790, or use the Sydney Health app or Anthem Member Portal.

If you are a Continuing Care Patient (see definition below), you may be eligible for 90 days of continuity of coverage at in-network cost-sharing while you transition to a new in-network provider. Anthem will notify affected patients; call Anthem Health Guides at (833) 414-5790 if you think you qualify and did not receive a notice by mid-December 2025.

Definition – Continuing Care Patient: A person who is (for example) undergoing a course of treatment for an acute or chronic serious condition, receiving inpatient care, scheduled for nonelective surgery, pregnant and receiving pregnancy-related care, or terminally ill and receiving treatment. (Call Anthem Health Guides for guidance.)

Transition of Care allows eligible participants to continue seeing a provider who becomes out-of-network in 2026 for up to 90 days at in-network benefit levels, if care is ongoing and medically necessary.

Call Anthem Health Guides (AHG) at 833-414-5790 to confirm eligibility and learn next steps.

Providers interested in joining the Anthem network can apply through the Availity provider portal using a special code. To get started and obtain the code, providers may:

Availity Provider Portal registration: https://www.availity.com/multi-payer-portal-registration/

Quarterly visit limits for certain therapies have been replaced with an annual review based on Medical Necessity once a specified number of visits is reached.

Limits on the length of treatment and requirements for timely commencement have been removed. Coverage is still subject to medical necessity review.

Visit limits for nutritional counseling are removed, and the requirement to see a Registered Dietitian has been removed. Nutritional counseling remains available only for certain chronic illnesses (for example, diabetes (including gestational diabetes), coronary artery disease, inflammatory bowel disease, cystic fibrosis, HIV/AIDS, cancer, or an eating disorder). Medical necessity review applies.

Age-and time-specific limits for foot orthotics are removed. Coverage remains subject to medical necessity.

Certain non-emergency ground ambulance services will be covered when medically necessary (for example, transport to a step-down rehabilitative facility from an inpatient hospital). Coverage is subject to medical-necessity review. Services to relocate a patient for family or personal convenience remain excluded. Pre-authorization is not required but is encouraged when practical.

365 days from the date of service. This applies to both out-of-network providers and participants who pay up front and submit their own claims. The claims submission process otherwise remains the same. Claims filed after 365 days may not be processed.

No. This deadline specifically standardizes the timeline for out-of-network claims.